Whether friend or foe to your online business, Amazon marketplaces are shaking up retail norms globally – from personalization to fulfillment. Even with Walmart and Jet.com encroaching on Amazon’s discount market share, the online mega mall added “tens of millions” of new Prime subscribers in 2016, reports investor site Motley Fool.

Whether friend or foe to your online business, Amazon marketplaces are shaking up retail norms globally – from personalization to fulfillment. Even with Walmart and Jet.com encroaching on Amazon’s discount market share, the online mega mall added “tens of millions” of new Prime subscribers in 2016, reports investor site Motley Fool.

Add consumer expectations for relevance, price and fulfillment speed, and retailers face notable challenges in attracting, converting and keeping customers online as they seek to nab their share of retail e-commerce sales that eMarketer forecasts will top $27 trillion in 2020.

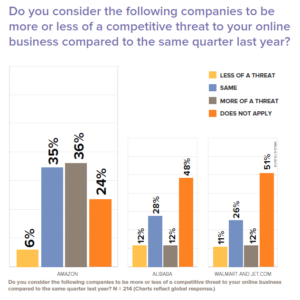

Findings in SLI Systems E-commerce Performance Indicators and Confidence (EPIC) Report illustrate the level of concern about various marketplaces among global online and multichannel merchants. The report provides insight from more than 200 e-commerce professionals — nearly 40% of whom sell on at least one Amazon marketplace, with 42% selling on additional marketplaces.

The key takeaway? Only 6% say Amazon is less of a threat.

“The Amazon Factor”

The e-commerce giant continues to challenge online businesses worldwide, with 11 Amazon marketplaces across North America, Europe and Asia.

Only 6% of the SLI study respondents feel Amazon poses less of a competitive threat. Thirty-two percent of U.S. respondents and 38% of those in the UK report that Amazon is more of a competitive threat compared to the same quarter last year.

And in Australia, where Amazon reportedly plans to open a new marketplace, 47% of respondents viewed the e-commerce giant as an increased threat.

Interestingly, Australian merchants chose “Advertising or Paid Search” as their top online retail initiative for the quarter, potentially indicating that the region’s merchants are gearing up for heightened online competition.

Other Mega Competitors

When it comes to Walmart and Alibaba, the “threat level” depends much more on region. Eighteen percent of the study’s U.S. respondents view Walmart/Jet.com as more of a threat. However, a majority of respondents in the UK (67%), Australia (60%) and New Zealand (62%) said the mega retailer was not a threat to their particular online businesses.

Looking at sentiment about Alibaba, the marketplace is a notable contender for APAC, where 20% of Australia-based and 31% of New Zealand-based merchants view Alibaba as more of competitive threat to their online business in Q1 2017 compared to the same quarter last year.

Whether selling on Amazon (friend) and/or competing with Amazon (foe), online retailers are having to keep pace with the giant as it sets the bar for the front office as well as the back office. When asked to select the single most important initiative for their online retail business, Customer Experience earned the top spot from 26% of all respondents, followed by Inventory, Logistics and Fulfillment, which earned 14% of the “votes.”

To learn about practical ways to combat Amazon, read the The Ecommerce Secret Weapon You Haven’t Heard Of on MediaPost’s SearchMarketingDaily.

Findings in the SLI Systems EPIC Report for Q1 2017 are based on a survey conducted between February 6, 2017 to March 6, 2017. For a copy of the full chart-packed report, visit: http://sitesearch.sli-systems.com/Epic-Report.html